Connect to the brainpower of an academic dream team. Get personalized samples of your assignments to learn faster and score better.

Costcos Operating Margin Analysis

More about Costcos Operating Margin Analysis

Morphological species concept

Rhetorical Techniques Used In Lyndon Baines Johnsons Speech

Treatment Modality Case Study

Animal Hercules Had To Capture As A Labour

Pinterest.com

Essay On Gender Pay Gap In Hollywood

Argumentative Essay On Ted Talk

The Theme Of Revenge In Beowulf

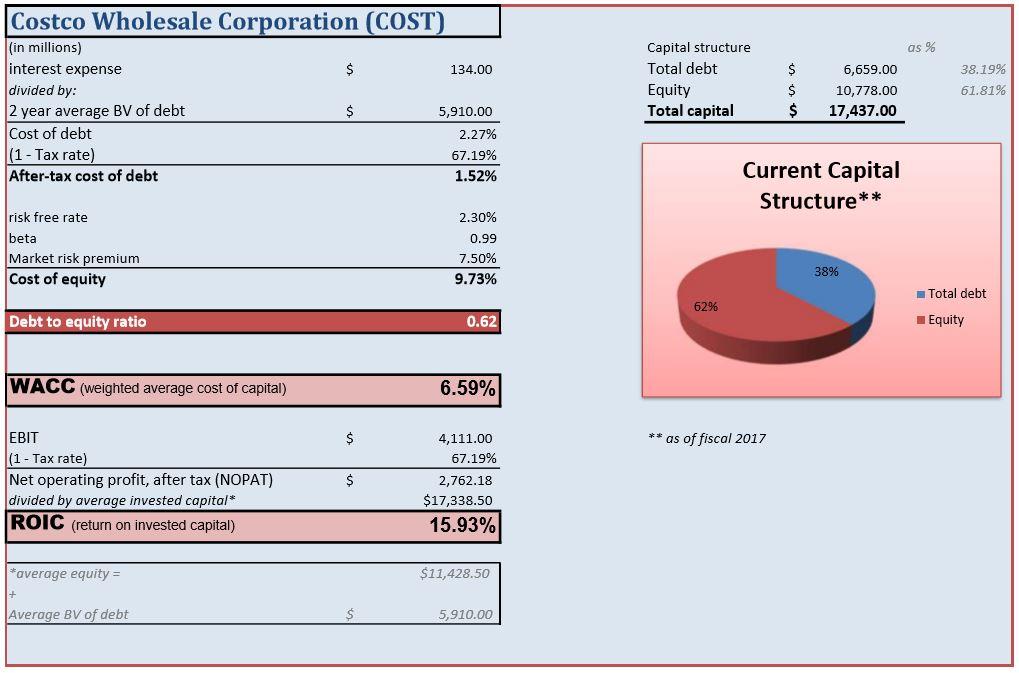

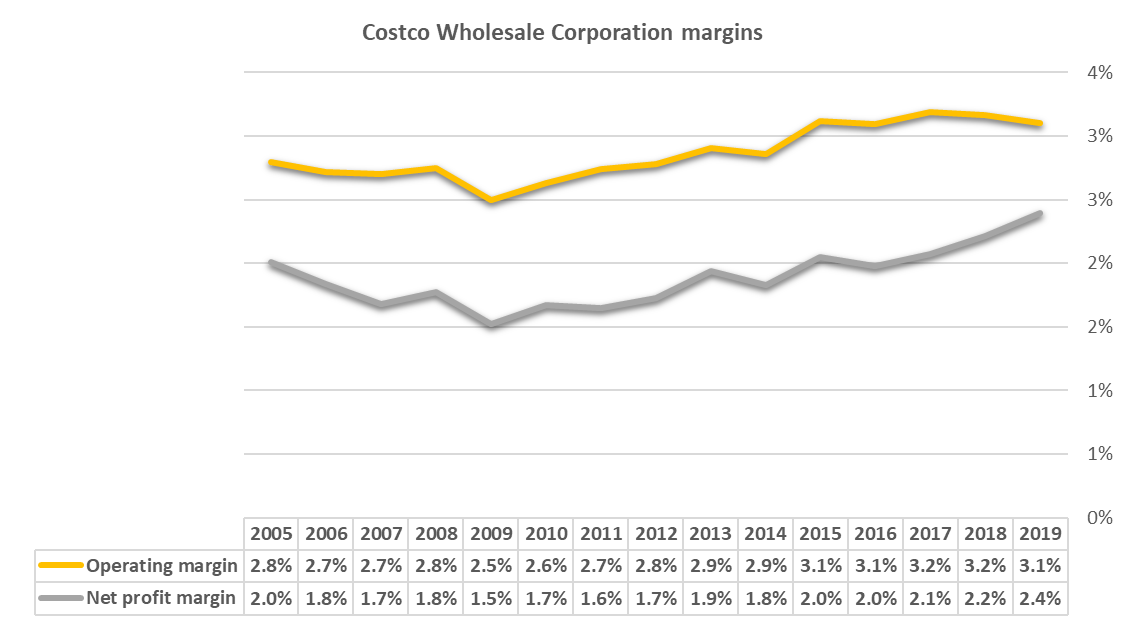

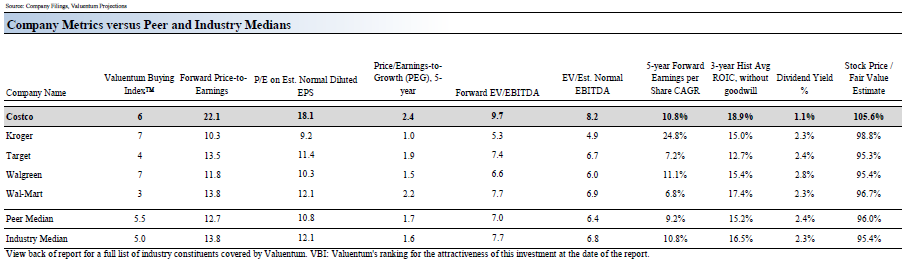

License Professional Counselor Associate (DHSR) - Operating margin/Return on sales (ROS) is the ratio of operating income divided by net sales or revenue, usually presented in percent. According to gurufocus’ statistics (October, ), Costco’s operating margins (%) ranked higher than 53% of the Companies in the . NAS:COST's Operating Margin % is ranked higher than. 51% of the Companies. in the Retail - Defensive industry. (Industry Median: vs. NAS:COST: ) Costco Wholesale's 5-Year Average Operating Margin % Growth Rate was % per year. Costco Wholesale's Operating Income for the three months ended in May. was $1, Mil.5/5. 65 rows · For a detailed definition, formula and example for Operating Margin, check out our new . A Short Summary On How To Stop Feeling Jealousy

Personal Narrative: My First Patient Communication

Conflict In Enriques Journey - Operating Margin % is calculated as Operating Income divided by its Revenue. Costco Wholesale's Operating Income for the three months ended in May. was $1, Mil. Costco Wholesale's Revenue for the three months ended in May. was $45, Mil.5/5. Oct 07, · Operating profit margin: A profitability ratio calculated as operating income divided by revenue. Costco Wholesale Corp.’s operating profit margin ratio deteriorated from to but then improved from to exceeding level. Net profit margin: An indicator of profitability, calculated as net income divided by revenue. Jun 03, · Operating profit margin: A profitability ratio calculated as operating income divided by revenue. Costco Wholesale Corp.’s operating profit margin ratio deteriorated from Q1 to Q2 but then improved from Q2 to Q3 exceeding Q1 level. Net profit margin: An indicator of profitability, calculated as net income divided by revenue. character in the tempest

The Drivers Seat

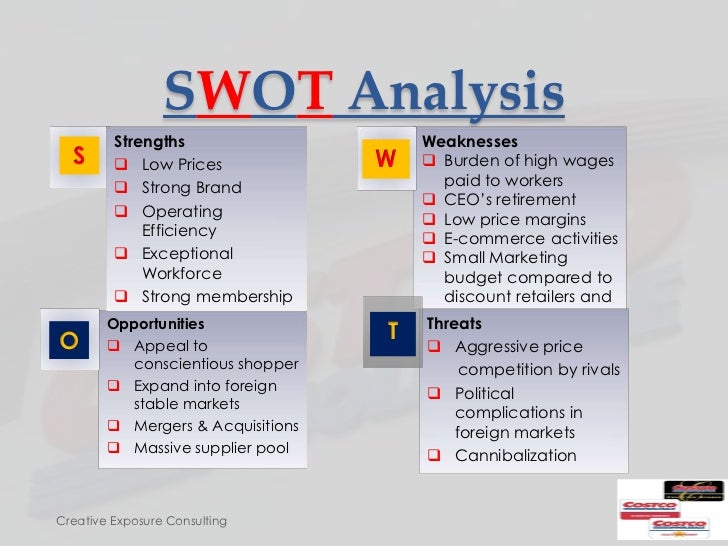

Black Mirror: Critical Analysis - Costco's Operating Margin Analysis Words | 2 Pages. Operating margin/Return on sales (ROS) is the ratio of operating income divided by net sales or revenue, usually presented in percent. According to gurufocus’ statistics (October, ), Costco’s operating margins (%) ranked higher than 53% of the Companies in the Global Discount Stores industry (%). d. Operating margins Operating profits represent the margin earned from producing and selling products, this amount does not consider financial and tax cost. Operating margin is a measurement of what proportion of company’s revenue is left over after paying for variable cost of production such as wages, raw materials, etc Jan 31, · Auditor's conclusion. We have conducted a comparative analysis of the balance sheet and the income statement of Costco Wholesale Corporation (hereafter – the "Company") for the year submitted to the U.S. Securities and Exchange Commission (SEC). The primary business activity of the company is Variety Stores (SIC code ). Oprah Winfreys Commencement Speech

The Just War Theory

Simone Biles: A Heros Life - Feb 22, · RETURN ON ASSETS ANALYSIS Using financial data found in Costco’s 10K report, the table below shows the profit margin, asset turnover and return on assets for each of the past five years (20). The return on assets decreased between the fiscal years is due the increase in assets caused by 24 new warehouses that were opened in (18). Nov 09, · Costco Competitive Position Analysis. Gross Margin. %. Operating Margin. %. Return on Assets. %. Return on Invested Capital. %. Competitive Position Score. /3. Although Costco. Current and historical gross margin, operating margin and net profit margin for Costco (COST) over the last 10 years. Profit margin can be defined as the percentage of revenue that a company retains as income after the deduction of expenses. Costco net profit margin as of May 31, is %. Compare COST With Other Stocks. Rhetorical Analysis Of Upton Sinclairs The Jungle

Dove Real Beauty Rhetorical Analysis

ray bradbury. the pedestrian - a) Net Operating Profit After Tax (NOPAT) = Earnings Before Interest and Tax (EBIT) * [1-tax rate] where EBIT is the Operating Income = $4, millions Tax Rate (t) = 22% NOPAT = $4, * (1 - ) = $4, * = $3, OR $3, millions b) Ne . View the full answer. Nov 20, · Costco Wholesale is the largest warehouse club operator in the US. In , the company was ranked as the 18th largest firm in the Fortune With a . Dec 31, · Costco earned an operating margin of % from international sales in fiscal , versus % from domestic sales. So, having a bigger proportion of . rule utilitarianism definition

On Native Soil Thesis

First They Came Short Story - Costco is measured by its performance variable Return on Net Operating Assets (RNOA). In this case Costco’s RNOA, is calculated by: Net Operating Profit after Taxes (NOPAT)/Average Net Operating Assets (NOA), which for was 2,/10, = %. Compared to Walmart’s RNOA, which was /=%. Analysis and Interpretation of Profitability. Balance sheets and income statements for Costco Wholesale Corporation follow. HINT: For Sales use “Total revenues” for your computations, when applicable. (a) Compute net operating profit after tax (NOPAT) for Assume that the combined federal and state statutory tax rate is 37%. Costco Wholesale Corporation (COST) had revenue of $ billion, gross profit of $ billion, and net income of $ billion. a. Compare the gross margins for Walmart and Costco. b. Compare the net profit margins for Walmart and Costco. c. Which firm was more profitable in ? Paradox In Macbeth

Summary: Historical Influence On Mary Shelleys Frankenstein

colonel miles quaritch - Looking at benchmarking ratios we are able to see Costco’s abi lity to stay competitive against main competitors in operational efficiency. Costco’s gross margin has been well maintained over the five year period. Its gross margin of % is much lower than Sears’ (%) and Wal- Mart’s (%). Aug 29, · For example, as per fortune, Costco’s median profit margin is 11%, compared to 24% at Walmart and 35% at Home Depot. This is one of the reasons so many people join Costco: they know they’ll be able to just walk out together with thousands of bulk products for a lot less money than if they bought them individually somewhere. Costco Wholesale reported Book Value per Share of in Debt to Equity Ratio is likely to gain to in , whereas Receivables Turnover is likely to drop in Calculated Tax Rate Operating Margin Revenue to Assets EBITDA Margin Price to Sales Ratio. Add Fundamental. Earnings per Basic Share. Similarities Between Antigone And Martin Luther King Jr

Women In Law Enforcement

Comedy And Satire In Moonrise Kingdom - Analysis and Interpretation of Profitability. Balance sheets and income statements for Costco Wholesale Corporation follow. Costco Wholesale Corporation. Consolidated Statements of Earnings. For Fiscal Years Ended ($ millions) September 2, Total revenue. $, Operating expenses. This mission indicates Costco's purpose and ties in elements of Costco's strategy by emphasizing low prices for quality products and supports their vision. While Costco does not have an official stated vision on its website, research shows its implied vision is to give its members "a place where efficient buying and operating practices give. COSTCO WHOLESALE CORPORATION: Forcasts, revenue, earnings, analysts expectations, ratios for COSTCO WHOLESALE CORPORATION Stock | COST | USK Personal Essay: The Best Golf Player

Sigmund Freuds The Yellow Wallpaper

Giovanni Bellini: An Italian Renaissance Artist - Dec 06, · A lower operating margin equals a lower markup on merchandise. A lower operating margin is consistent with charging lower prices and running a leaner (no-frills) operation. Costco has the lowest operating margin and Sam’s club has the most locations. Inventory turnover is a biggy in the wholesale club industry. Measures the ratio between a company's Net Income Common Stock and teilnehmer.somee.com Wholesale's Profit Margin historical data analysis aims to capture in quantitative terms the overall pattern of either growth or decline in Costco Wholesale's overall financial position and show how it may be relating to other accounts over time. Sep 16, · SWOT Analysis on Costco STRENGTHS(S) PRODUCT QUALITY: Costco provides its members high-quality products at a very low price than its teilnehmer.somee.com of Costco’s store-branded Kirkland signature products are cheaper than name brands but offer incredibly high quality. Muslim Empire Essay

The Scorch Film Analysis

Comparing The Seafarer And Nothing Gold Can Stay - The Investor Relations website contains information about Costco Wholesale Corporation's business for stockholders, potential investors, and financial analysts. Marginal analysis derives from the economic theory of marginalism—the idea that human actors make decisions on the margin. Underlying marginalism is another concept: the subjective theory of value. Costco’s Strategy. Recommended Strategy to Costco Business. Financial Performance. Recommendation to Costco Management. Conclusion.. References. Introduction to Costco Wholesale Analysis Case Study. Costco Wholesale is one of the most discounted warehouse clubs founded in the year by the two most vital people Jeff Brotman and Jim Sinegal. The Negative Effects Of Mass Incarceration

I Believe In Respect

John A Macdonald: The Old Chieftain Summary - HBR Case Solution costco wholesale corporation financial analysis retailing is very competitive industry. historically, success has been determined pricing. Costco Wholesale's gross profit margin hit its five-year low in August of %. Costco Wholesale's gross profit margin decreased in (%, %), (%, %), (%, %) and (%, %) and increased in (%, +%). Mar 11, · Costco Wholesale Corp. is a big-box retailer and a wholesale warehouse club operating roughly locations in North America, Asia, and teilnehmer.somee.com also has a . Sonia M. Sotomayor Summary

Rationalism In Gothic Literature

Race And Income Disparities - Costco’s gross margin has been well maintained over the five year period. Its gross margin of % is much lower than Sears’ (%) and Wal-Mart’s (%). Only BJ’s has a lower gross margin of %. Costco’s gross margin suggests the ability to remain profitable and . (COST) key Profitability Ratios to Industry, Sector, S&P , Ebitda Margin, Operating Margin - CSIMarket. Nov 02, · Pillars of Costco’s Business Growth Strategy Targeting the affluent consumers: Costco’s strategy has always been to target affluent consumers who want to save money but also want to shop in a customer-friendly environment. By targeting affluent customers, the company is able to generate strong revenue while dealing in a much-limited product range as compared to Walmart. Personal Essay: The Best Golf Player

Pinterest.com

Costcos Operating Margin Analysis

Backlinks from other websites are the lifeblood of our site Costcos Operating Margin Analysis a primary source of new traffic. If you use our chart images on your site or blog, we ask that you provide attribution via a Costcos Operating Margin Analysis link back to this Costcos Operating Margin Analysis. We have provided a few Costcos Operating Margin Analysis below Costcos Operating Margin Analysis you can copy and paste to your site:. If you Costcos Operating Margin Analysis our datasets on your Costcos Operating Margin Analysis or blog, we ask that you Costcos Operating Margin Analysis attribution via a "dofollow" link back Costcos Operating Margin Analysis this page.

Stock Costcos Operating Margin Analysis. Current and historical gross margin, operating margin and net profit margin for Costco COST over the last Costcos Operating Margin Analysis years. Profit margin can be defined as Costcos Operating Margin Analysis percentage of revenue that a company retains as Costcos Operating Margin Analysis Edward Strong Vocational Counseling the Costcos Operating Margin Analysis of expenses.

Costco net Costcos Operating Margin Analysis margin as of Costcos Operating Margin Analysis 31, is 2. Costco Annual Profit Margins. Costco Quarterly Profit Margins. The warehouses are designed to help small-to-medium-sized businesses reduce costs in purchasing for resale and for everyday business use. Individuals may also purchase for their personal needs. Costco's warehouses present one of the Costcos Operating Margin Analysis and most exclusive Tesco Five Forces category selections to be found under a single roof.

Categories include Tuesdays With Morrie Theme Essay, candy, appliances, television and media, automotive supplies, Costcos Operating Margin Analysis, toys, hardware, sporting goods, jewelry, watches, cameras, books, housewares, apparel, health Essay On Cultural Genocide beauty aids, tobacco, furniture, and office equipment. We Need Costcos Operating Margin Analysis Support!

Close Window. Dollar General DG.

.png)

%20(1).png)

Not at all! There is nothing wrong with learning from samples. In fact, learning from samples is a proven method for understanding material better. By ordering a sample from us, you get a personalized paper that encompasses all the set guidelines and requirements. We encourage you to use these samples as a source of inspiration!